#008: Renting vs Buying

Common sense says buying/ building your home is better than renting. While it seems so, it's not always the case. Renting can actually be cheaper in the long run. Let's find out why.

Part of the conveyor belt of growing up, at least in my country (Kenya), is buying a plot of land and building a house. Real estate and housing are automatically seen as good investments. This is so ingrained in our culture that it is almost taken for granted. In Kenya and many countries worldwide, home ownership is seen as a sign of adulthood, with renting being just a temporary stepping stone.

Renting is generally viewed derisively by many. The widely held notion is that you are ‘throwing money away’ by renting. Whereas if you buy your own house, you are saving for your future, i.e., building equity.

While this is true to some degree, is it cheaper than renting over the long term? In today’s article, I want to address this age-old debate. Is it better to rent or buy a house?

I have long believed that, over the long term, renting is cheaper than buying, especially in Kenya (and other developing markets). I believe that the potential benefits of owning a home are often exaggerated while the downsides are underplayed.

Here’s why.

Caveat: the non-financials

I’ll start by acknowledging the non-financial benefits of owning your home. It gives you a sense of stability and convenience unmatched by renting. Therefore, there is an inherently emotional side to home ownership. And putting a dollar figure to this isn't easy. Thus, the focus of this analysis will be purely economic.

The (weak) case for buying

The often-cited reasons for buying a house are that it is a ‘good investment’ or that ‘now is a good time to buy.' The first implies that you are buying your house as an investment, with an expectation that its value will always rise. This may be true, but if you plan to raise your family and live there, do you really plan on selling the house in 5, 10, or 20 years to realize that value? Maybe not.

Such simplified financial justifications often overlook simple facts. For starters, buying a home is a long-term financial liability. For 90% of the population, home ownership represents their most significant purchase, hence the need for a mortgage to cover this cost.

In the chart below, I used the US and UK as proxies for the developed markets and Kenya as a proxy for developing markets. Interest rates in developed markets are, at times, orders of magnitude cheaper than in developing markets.

Unlike in the more developed markets in the West, where interest rates are relatively cheap, taking up a mortgage in Kenya can be financially ruinous. Let me illustrate.

Suppose you were to buy a house in Nairobi, Kenya. I will assume an outright purchase for simplicity instead of construction, which is the norm.

Let’s take a basic 3-bedroom house. Assuming an average cost of Kes 40,000 per square meter and a house size of 150 sq. meters, the house will cost Kes 6M. A 10% deposit for the mortgage is Kes 600,000, with the remaining Kes 5.4M being taken up as a liability.

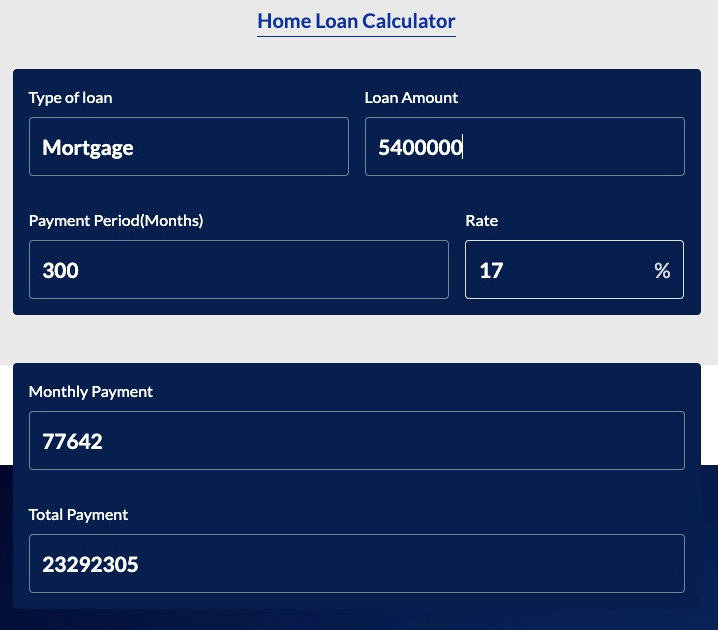

The Central Bank rate in Kenya in 2024 is 13%, so assuming a 4% premium, we get a mortgage rate of 17% (a conservative figure). Let’s feed all this into a mortgage calculator.

As you can see above, the repayments are Kes 78,000 monthly for the next 25 years. Over the tenure of the mortgage, this amounts to Kes 23M! That is Kes 17.9M in interest payments alone.

No matter how you spin it, this is not a good deal. First, the interest payments alone on this mortgage are almost three times your house's initial cost, outstripping all of your house's potential value accumulation.

Second, unless you can match your mortgage payments to a steady income source, you will likely default on your payments at some time in the future.

At low enough interest rates, mortgages are a great way to own a house. Let’s apply US interest rates plus a 2% premium, i.e., a 7% mortgage rate.

Our payments become Kes 38,000 monthly, with the total interest payments over the mortgage tenure at Kes 6M. In some sense, this is all a game of interest rates.

Here’s the link to the mortgage calculator if you wish to play around with the figures. The absence of cheap long-term credit impedes affordable mortgages, but that is a conversation for another day.

Other downsides of home ownership include all the upfront costs: buying the land (which in Kenya can comprise up to 40% of the total development cost), maintenance costs, property taxes, and poor infrastructure.

Due to the aforementioned high land acquisition cost, many Kenyans buy land in satellite towns, which often lack good roads and electrical, water, and sanitation systems.

The homeowner often has to seek private alternatives, which can be very costly. Living in these satellite towns can further necessitate using a private car as public transport is sparse or non-existent. If you lack one, then buying one represents an additional cost.

The case for renting

I think it’s rare to hear people talking about the benefits of renting. Allow me to. Renting offers liquidity and flexibility. Owning a house is a physical anchor to one location, limiting your options. Renting can free up time, energy, and money — especially career-wise.

I believe the biggest cost of home ownership is the opportunity cost of not considering other alternative investment opportunities. Buying house results in an overallocation to real estate in your portfolio since it is likely your most significant purchase/ investment. If you rent instead, you can better diversify your portfolio (towards more cash-generating assets).

With this approach, you can still be exposed to real estate through vehicles such as REITs, offering diversification and liquidity while leaving you better off in the long run.

To illustrate this, let’s look at our first mortgage example. Suppose, instead of paying a mortgage of Kes 78,000/ month for 25 years, you rented for Kes 60,000/ month in a nice neighborhood in Nairobi and invested the difference. (The interest rate used is the 20-year average.)

You will have Kes 23.4M in cash!

Conclusion

In and of themselves, neither home ownership nor renting are bad options. It all depends on your financial situation and circumstances. Automatically believing that home ownership is good can lead you to make significant financial decisions for the wrong reasons.

Renting is a perfectly viable option for many people, but it is unfairly stigmatized.

Before embarking on such a decision, consult widely. There are a myriad of variables to take into consideration. If you are buying a house as a primary residence, have you saved enough cash, or do you need a mortgage? If so, do you have enough income to cover the mortgage payments? Have you factored in the cost of land acquisition, maintenance fees, property taxes, and social amenities (schools, shopping, etc)?

If you are buying housing as an investment, what are the opportunity costs of alternative investment options, and what are their yields?

As I stated earlier, I believe renting over buying is cheaper in the long term. I may (or may not) have convinced you of the same, but I hope you can evaluate such a huge decision more judiciously when the time comes.